Overview of the electricity and coal market in Kazakhstan

The electric power industry of the Republic of Kazakhstan operates within the Unified Electric Power System (UES), which is a combination of power plants, transmission lines, and substations providing reliable and high-quality electricity supply to consumers throughout the country.

The energy sector is regulated by an authorised state body – the Ministry of Energy of the Republic of Kazakhstan8, including the renewable energy sector9. The state policy in the field of natural monopolies regarding regulated services for electricity transmission, production, transmission, distribution, and supply of thermal energy is implemented by the Natural Monopolies Regulation Committee under the Ministry of National Economy of the Republic of Kazakhstan10. The Ministry of Industry and Infrastructural Development of the Republic of Kazakhstan provides guidance in the coal industry11.

8 Law of the Republic of Kazakhstan On Electric Power Industry No.588-II of 9 July 2004.

9 Law of the Republic of Kazakhstan On Supporting the Use of Renewable Energy Sources No.165-IV of 4 July 2009.

10 Law of the Republic of Kazakhstan On Natural Monopolies No.204-VI dated 27 December 2018.

11 Code of the Republic of Kazakhstan On Subsoil and Subsoil Use No.125-VI dated 27 December 2017.

Electricity and capacity market of Kazakhstan

Electricity balance

In 2024, electricity generation in the UES was mainly provided by coal-fired thermal power plants (TPPs) – 74.9%.

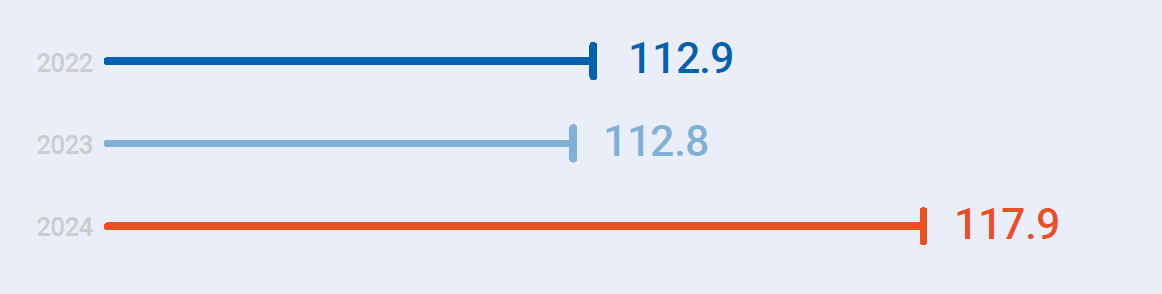

According to the System Operator, in January– December 2024, Kazakhstan's power plants generated 117.9 billion kWh of electricity, which is 4.3% (5.1 billion kWh) more compared to 2023.

Electricity generation/consumption balance, billion kWh

| Electricity indicators | 2022 | 2023 | 2024 | Δ 2024/2023, % |

|---|---|---|---|---|

| Electricity generation, including: | 112.86 | 112.82 | 117.92 | 4.3 |

| Thermal power plants (TPP) | 88.62 | 87.36 | 88.38 | 1.1 |

| Gas turbine power plants (GTPP) | 10.94 | 11.02 | 11.92 | 0.73 |

| Hydropower plants (HPPs) | 9.19 | 8.75 | 11.22 | 22.1 |

| Wind power plants (WPP) | 2.36 | 3.80 | 4.50 | 15.4 |

| Solar power plants (SPP) | 1.75 | 1.89 | 1.90 | 0.7 |

| Biogas plants (BGU) | 0.04 | 0.001 | 0.01 | -127.3 |

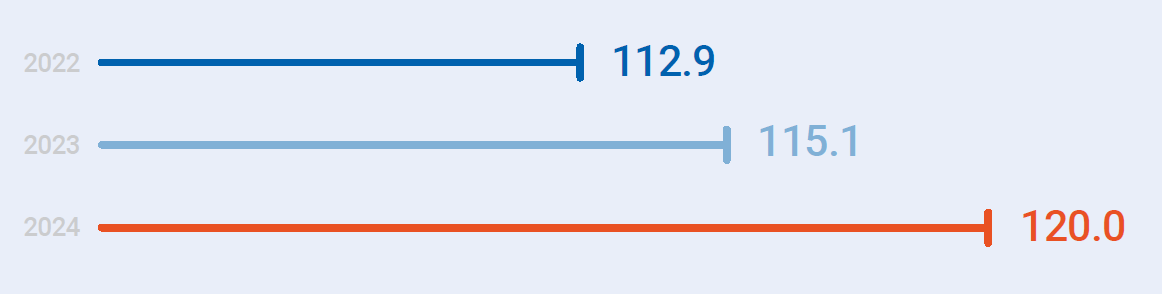

| Electricity consumption | 112.94 | 115.07 | 120.00 | 4.1 |

| Balance-flow "+" deficit, "-" surplus, including: | 0.79 | 2.24 | 2.08 | -7.9 |

| Russia | 0.47 | 3.62 | 3.41 | -6.0 |

| Central Asia | -0.40 | -1.37 | -1.33 | 3.1 |

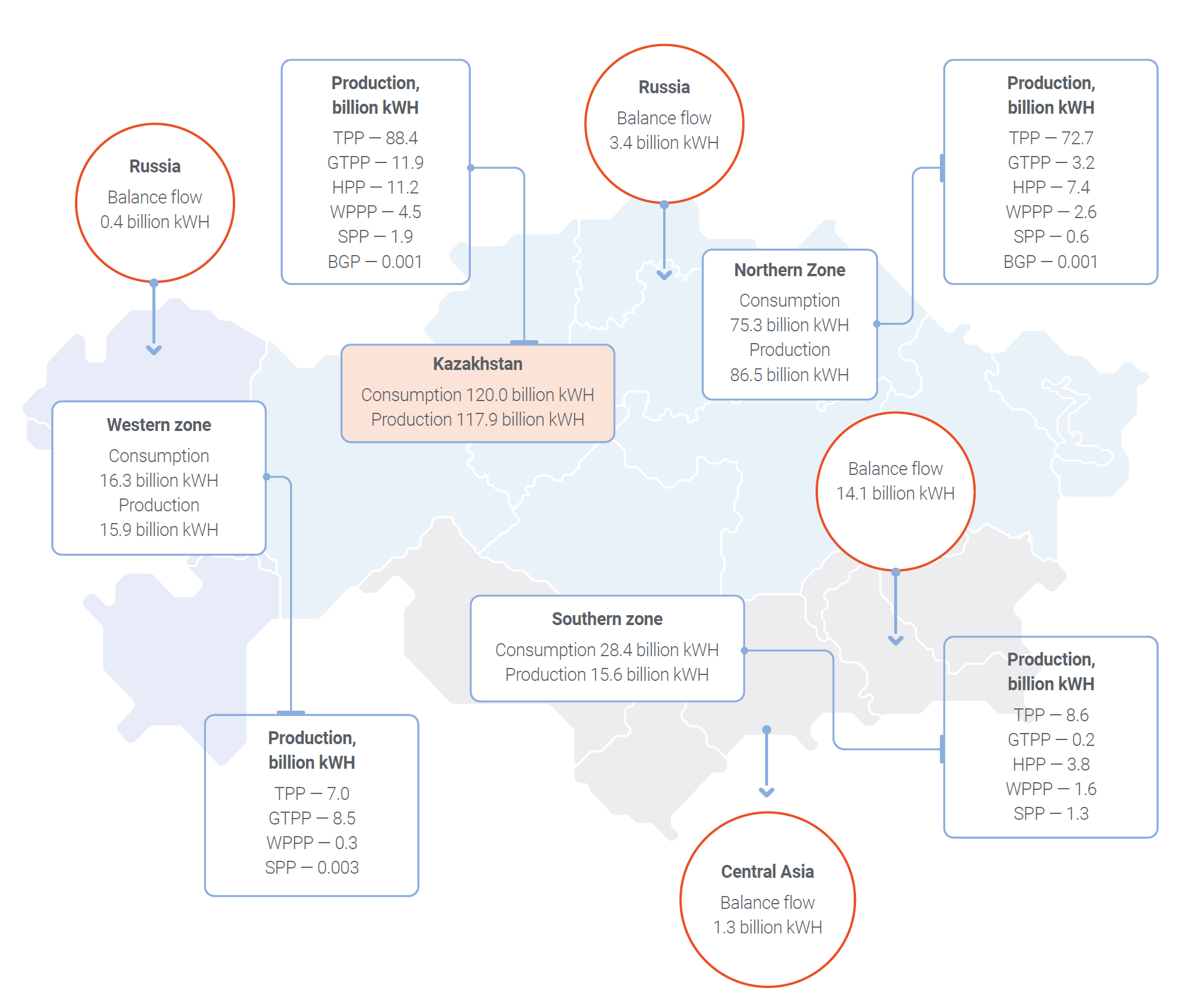

The UES of the Republic of Kazakhstan is conditionally divided into three zones – Northern, Southern and Western.

Unified power system of the Republic of Kazakhstan

In the Northern zone, where the main coal deposits and hydropower resources are located, 73.3% (86.5 billion kWh) of the country’s total electricity was generated in 2024. The surplus Northern zone covers electricity deficits in the Southern zone and also provides Kazakhstan’s export potential.

In 2024, electricity generation in the Southern Zone amounted to 13.2% (15.6 billion kWh) of the total volume. The electricity deficit in the Southern Zone was covered by supplies from the Northern Zone.

During the reporting period, the Western zone produced 13.5% (15.9 billion kWh) of the total electricity generated. The peculiarity of this zone is the absence of power grid connections with the power grids of the Northern and Southern zones of the UES of Kazakhstan.

According to the System Operator, power plants in the Republic of Kazakhstan generated 117,915.4 million kWh of electricity in January–December 2024, which is 5,092.3 million kWh or 4.3% more than in the same period of 2023. A decrease in generation was observed in the western and southern zones of the UES of Kazakhstan.

In January–December 2024, electricity generation increased in almost all regions of Kazakhstan compared to the same period in 2023.

At the same time, a decrease in electricity production was observed in Akmola and Kyzylorda regions.

According to the System Operator, in the period from January to December 2024, there was an increase in electricity consumption in the Republic of Kazakhstan compared to the same period in 2023 by 4,927.9 million kWh or 4.1%. Thus, in the northern and southern zones of the country, consumption increased by 2.4% and 5.3%, respectively.

In January–December 2024, compared to the same period of 2023, electricity consumption among large consumers increased by 1,638.2 million kWh, or 4.5%. In particular, in January–December 2024, electricity consumption by Samruk-Energy JSC companies increased by 1,656.6 million kWh, or 19.6% compared to 2023.

Electricity production in the Republic of Kazakhstan, billion kWh

Electricity consumption in the Republic of Kazakhstan, billion kWh

Electricity exports and imports

In 2024, electricity exports to Russia increased by 21.2% compared to 2023. At the same time, there was also a significant increase in electricity imports from Russia, which rose by 47.3%.

Electricity exports/imports of the Republic of Kazakhstan, billion kWh

| Areas | 2023 | 2024 | Δ 2024/2023, % |

|---|---|---|---|

| Kazakhstan's exports: | 1.73 | 2.70 | 35.8 |

| to Russia | 1.15 | 1.46 | 21.2 |

| in the ECO of Central Asia | 0.57 | 1.24 | 54.0 |

| Kazakhstan's imports: | 2.28 | 4.33 | 47.3 |

| from Russia | 2.21 | 4.33 | 47.3 |

| Balance-flow "+" deficit, "-" surplus | 0.55 | 1.63 | 66.3 |

Samruk-Energy JSC’s Position in the electricity market of Kazakhstan

Electricity generation

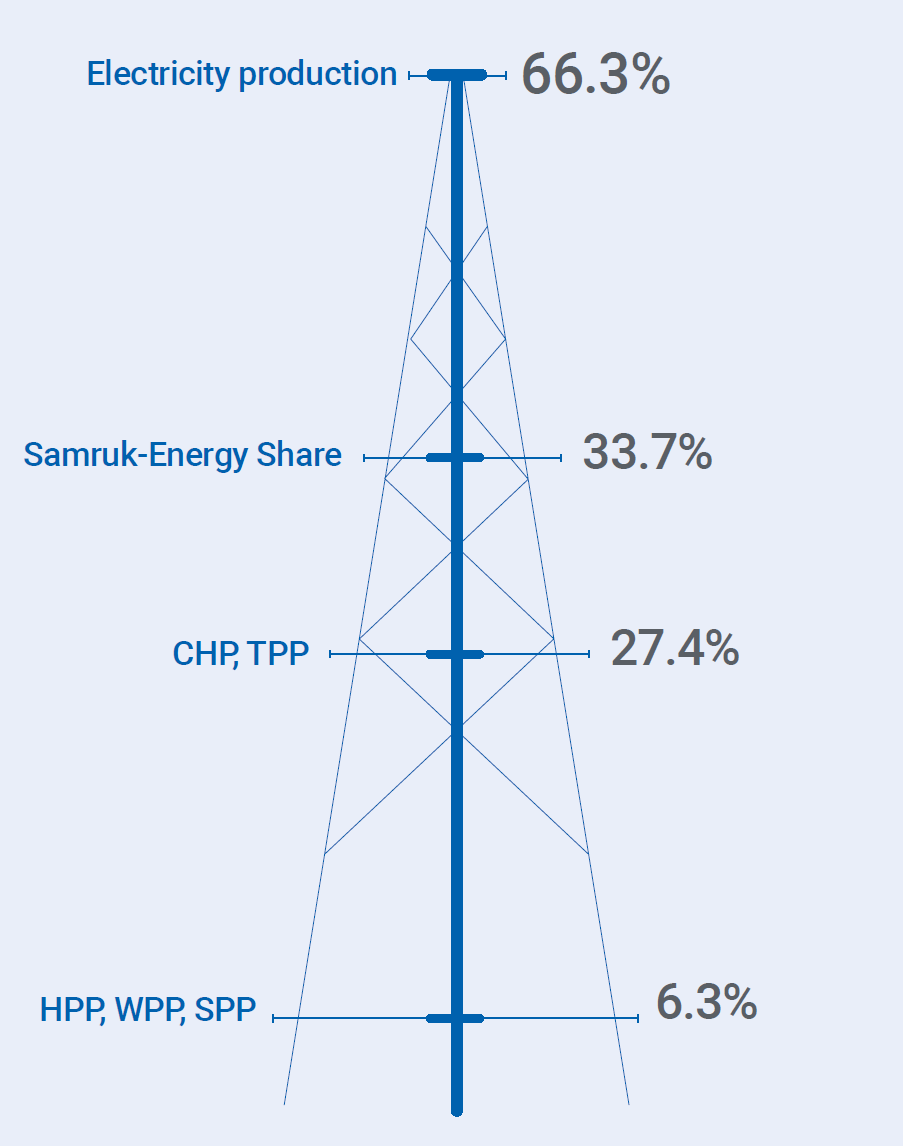

Share of Samruk-Energy JSC in total electricity generation in the Republic of Kazakhstan for 2024

Share of generating companies in the electricity market in 2024, %

| Electricity producers in the Republic of Kazakhstan | Indicator |

|---|---|

| Samruk-Energy JSC | 33.7 |

| ERG | 16.0 |

| Central Asian Electric Power Corporation JSC | 4.9 |

| Kazzinc LLP | 2.9 |

| Kazakhmys Energy LLP | 4.5 |

| KKS LLP | 5.3 |

| Zhambyl SDPP JSC | 2.9 |

| Others | 29.8 |

Electricity generation volumes in Kazakhstan, billion kWh

| Electricity producers in the Republic of Kazakhstan | 2022 | 2023 | 2024 |

|---|---|---|---|

| Samruk-Energy JSC | 35.88 | 35.33 | 39.77 |

| ERG | 19.23 | 19.16 | 18.87 |

| Central Asian Electric Power Corporation JSC | 5.09 | 5.59 | 5.75 |

| Kazzinc LLP | 2.69 | 2.33 | 3.37 |

| Kazakhmys Energy LLP | 4.22 | 5.80 | 5.35 |

| KKS LLP | 6.14 | 6.10 | 6.20 |

| Zhambyl SDPP JSC | 3.65 | 3.07 | 3.44 |

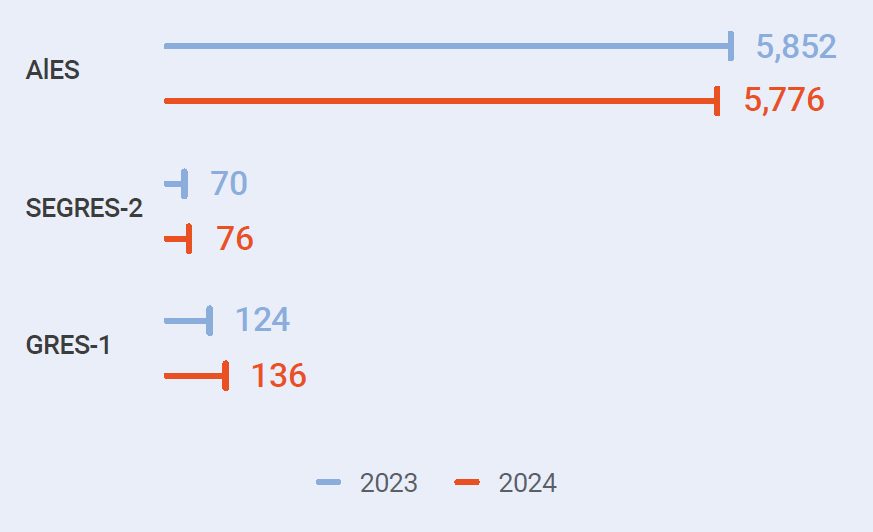

Electricity generation at TPPs, CHPPs, million kWh

| Indicator | 2023 | 2024 |

|---|---|---|

| EGRES-1 | 22,870 | 22,544 |

| EGRES-2 | 5,659 | 6,045 |

| AIES (CHPP-1, -2, -3) | 3,955 | 3,724 |

Electricity generation in 2024 amounted to 39,772 million kWh, which is 12.6% or 4,442 million kWh higher than last year. The main increase was due to Moynak HPP JSC by 238 million kWh (28.6%), Shardara HPP JSC by 54 million kWh (10%) due to increased water inflow, Ekibastuz GRES-2 JSC by 386 million kWh (7%) due to increased electricity sales to the Single Buyer as a result of equipment failure at Ekibastuz GRES-1 LLP. The 2024 electricity generation volume also included the output of UKHPP and SHPP, included in the perimeter of Samruk-Energy JSC from 2024.

Competitive advantages of Samruk-Energy JSC in the electric power market of the Republic of Kazakhstan in 2024:

- significant reserves of steam coal with low production costs;

- sufficient energy capacities with a relative level of wear and tear across the country;

- state support, as well as support from Samruk-Kazyna JSC (SKKZ).

Challenges for Samruk-Energy JSC:

- high level of asset wear;

- insufficient return on investment when implementing social projects;

- high level of debt load;

- regulatory environment in tariff setting;

- limited ability to manage price offers;

- limitations on export supplies of steam coal due to the substitution of Ekibastuz coal in traditional markets, as well as non-competitiveness in other markets due to low coal parameters;

- lack of exploration works to increase coal production.

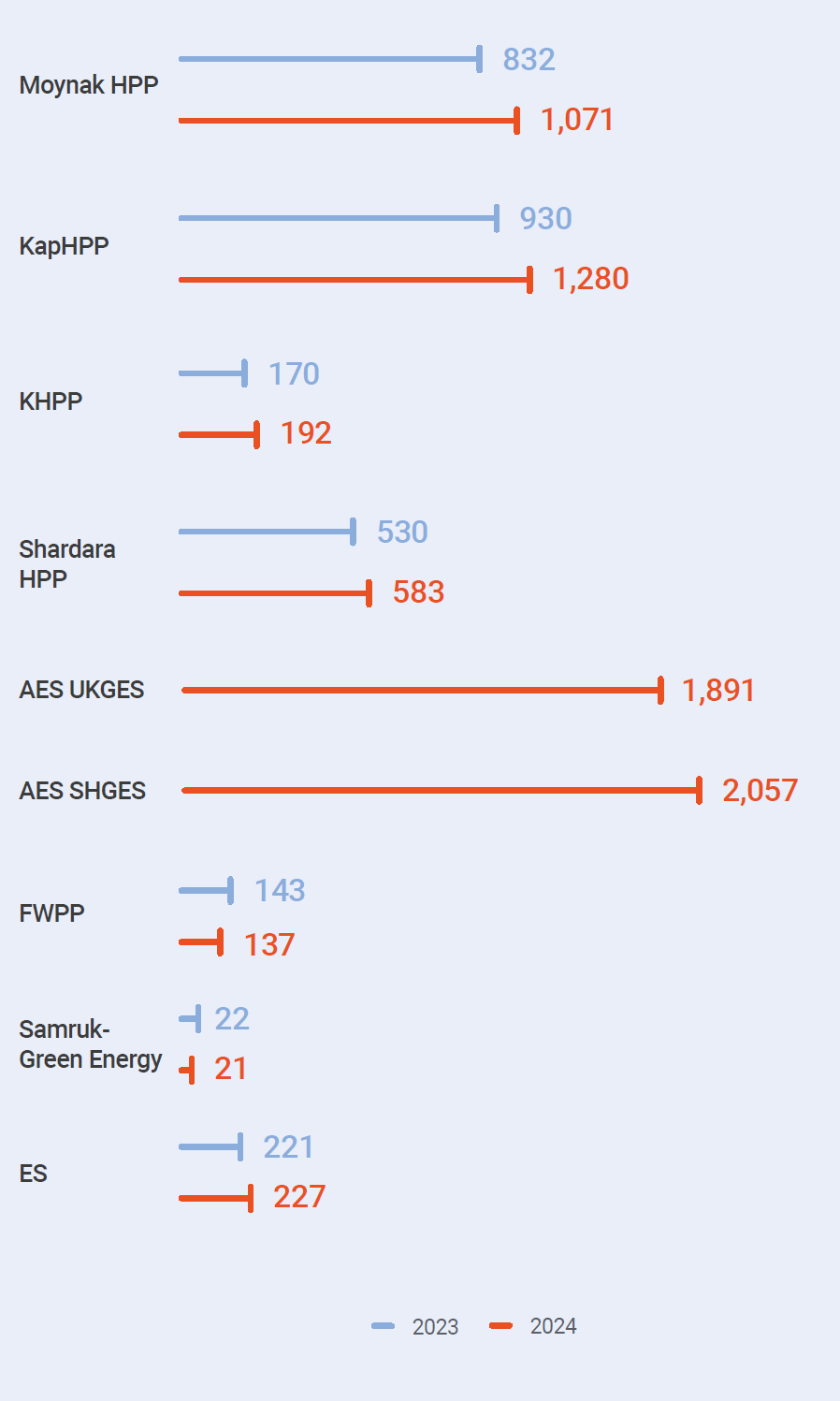

Electricity production volumes (million kWh) at HPP, WPP, SPP

Outlook for the future period

Electricity generation volumes for 2025 are projected with a gradual increase compared to the actual 2024 figures. The increase in electricity generation in 2025 by 3% is mainly forecasted due to the growth in electricity consumption.

Heat energy production

Heat energy production in 2024 amounted to 7,491 thousand Gcal. Compared to the same period last year, the increase is 17%, which occurred due to the inclusion of Energy Solutions Center LLP (Ekibastuz CHPP) in the consolidation perimeter.

Dynamics of changes in heat production, '000 Gcal

Outlook for the future period

Heat energy production volumes in the 2025 plan are forecasted to increase by 10% compared to the actual 2024 figures, mainly due to the fact that in 2024, the volume of Energy Solutions Center LLP (Ekibastuz CHPP) was accounted for 5 months from the start of the trust management agreement.

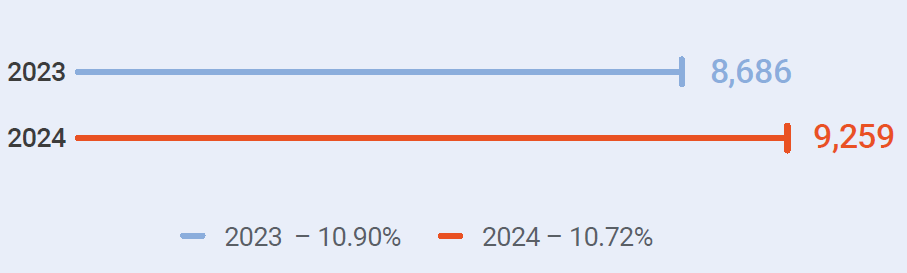

Electricity transmission

The volume of electricity transmission through Alatau Zharyk Company JSC (AZhK) grids in 2024 amounted to 9,259 million kWh, which is 7% or 572 million kWh higher than the 2023 actual.

Dynamics of electricity transmission

Outlook for the future period

In terms of electricity transmission and distribution volumes, an increase of 3% is expected in 2025 compared to the 2024 actual, due to the projected growth in consumption in the Almaty region.

Electricity sales

The total volume of electricity sales by the energy supplying organisation AlmatyEnergoSbyt LLP for the reporting period amounted to 8,737 million kWh, which is 23% higher than the same period in 2023 and associated with an increase in electricity consumption in the Partnership’s service area and changes in legislation in the electricity sector.

AlmatyEnergoSbyt LLP

| Name | Actual 2023 | Fact 2024 | Off. | Δ 2024/2023, % |

|---|---|---|---|---|

| Number of consumers, incl: | 929,929 | 987,583 | 57,654 | 106% |

| Population | 891,214 | 943,134 | 51,920 | 105% |

| Legal entities | 38,715 | 44,449 | 5,734 | 114% |

| Sales volume, million kWh | 7,086 | 8,736 | 1,650 | 123% |

Outlook for the future period

Electricity sales volume in the 2025 forecast will increase by 3% from the 2024 actual, due to the projected growth in electricity consumption in the service area of AlmatyEnergoSbyt LLP.

Development of RES in the Republic of Kazakhstan

Renewable energy is one of the most promising areas for investment. Despite the significant growth of this sector in recent years – since 2014, the installed capacity of RES facilities in the Republic of Kazakhstan has increased more than 17 times – the share of solar and wind generation in the country, both in absolute and relative terms, still significantly lags behind other developed and developing countries.

According to the Ministry of Energy of the Republic of Kazakhstan, as of 1 January 2025, there are 153 RES facilities in operation in Kazakhstan with a total capacity of about 3,032 MW, providing 6.4% of the total electricity in the country. In the reporting period, there was an increase in electricity generation using solar and wind power plants, as well as small HPPs. Overall, in 2024, RES facilities (SES, WES, BGP, small HPPs) generated 7.5 billion kWh of electricity, which is 12.5% more than in 2023.

In 2024, 8 new renewable energy facilities with a capacity of 163.5 MW were commissioned in Kazakhstan. In 2014, the installed capacity of RES facilities in operation in the country was 177.52 MW, and in 2024 it exceeded 3,032 MW.

Electricity generation by RES facilities of Samruk- Energy JSC (SPP, WPP and small HPPs) for January– December 2024 was 578 million kWh, which corresponds to 7.7% of the total share of RES electricity generation in the Republic of Kazakhstan.

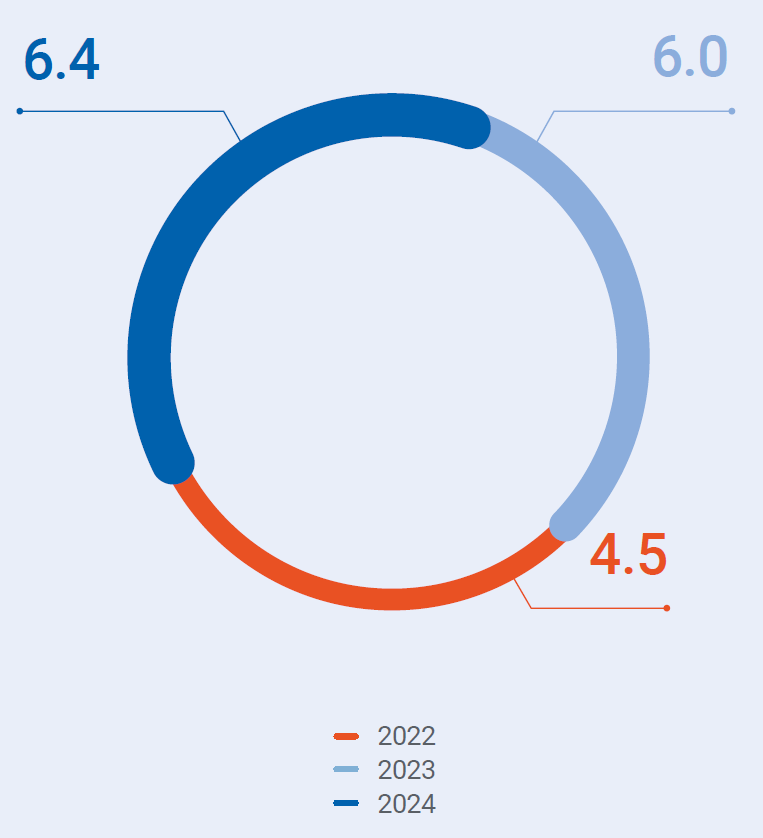

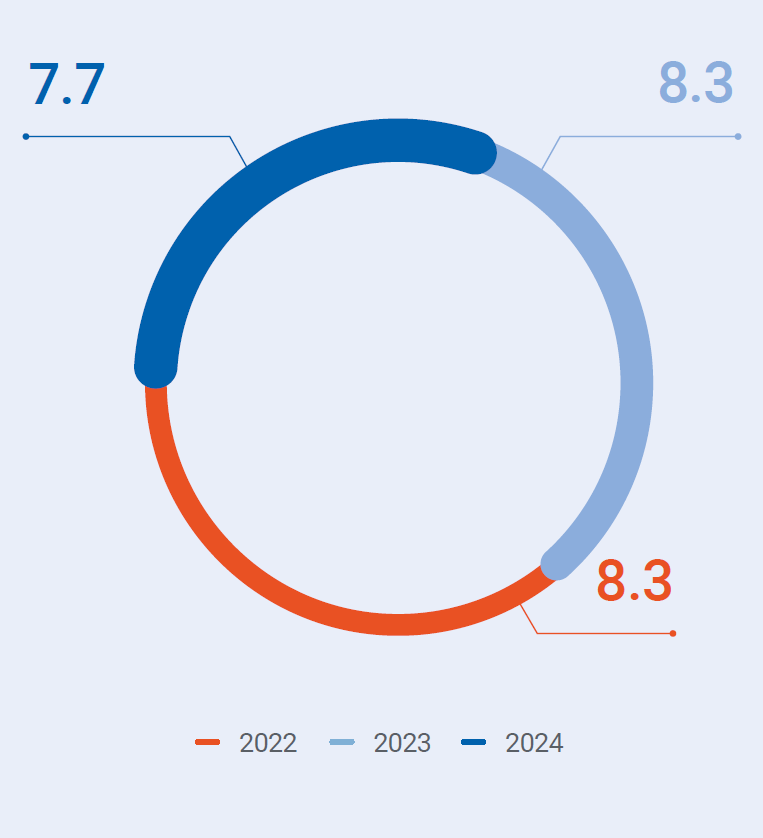

Share of Renewable Electricity Generation in the Electricity Market of Kazakhstan, %

Share of RES power generation by Samruk-Energy JSC in Kazakhstan, %

Electricity generation by RES facilities of Samruk-Energy JSC, million kWh

| Group of companies of Samruk-Energy JSC | Installed capacity, MW | 2023 | 2024 |

|---|---|---|---|

| AIES JSC, cascade of small HPPs | 43.7 | 169.5 | 192.2 |

| Samruk-Green Energy LLP, SPP | 3.4 | 5.6 | 5.42 |

| Samruk-Green Energy LLP, Shelek WPP | 5 | 16.1 | 15.8 |

| First Wind Power Plant LLP, WPP | 45 | 142.6 | 137.4 |

| Energy of Semirechye LLP, Shelek WPP | 60 | 220.8 | 227.3 |

| Total | 157.1 | 554.6 | 578 |

Electricity generation by HPPs, WPPs, SESs, million kWh

| Indicator | 2023 | 2024 |

|---|---|---|

| Moynak HPP | 832 | 1,071 |

| Kapchagayskaya HPP | 930 | 1,280 |

| Almaty HPP Cascade | 170 | 192 |

| Shardara HPP | 529 | 583 |

| Ust-Kamenogorsk HPP | 1,46612 | 1,891 |

| Shulbinsk HPP | 1,632 | 2,057 |

| FWPP | 142 | 137 |

| Samruk-Green Energy | 22 | 21 |

| Energy of Semirechye LLP | 220 | 227 |

12 UKHPP and SHHPP are not taken into account in the total generation of Samruk-Energy JSC in 2023, as they entered the Company's perimeter in 2024.

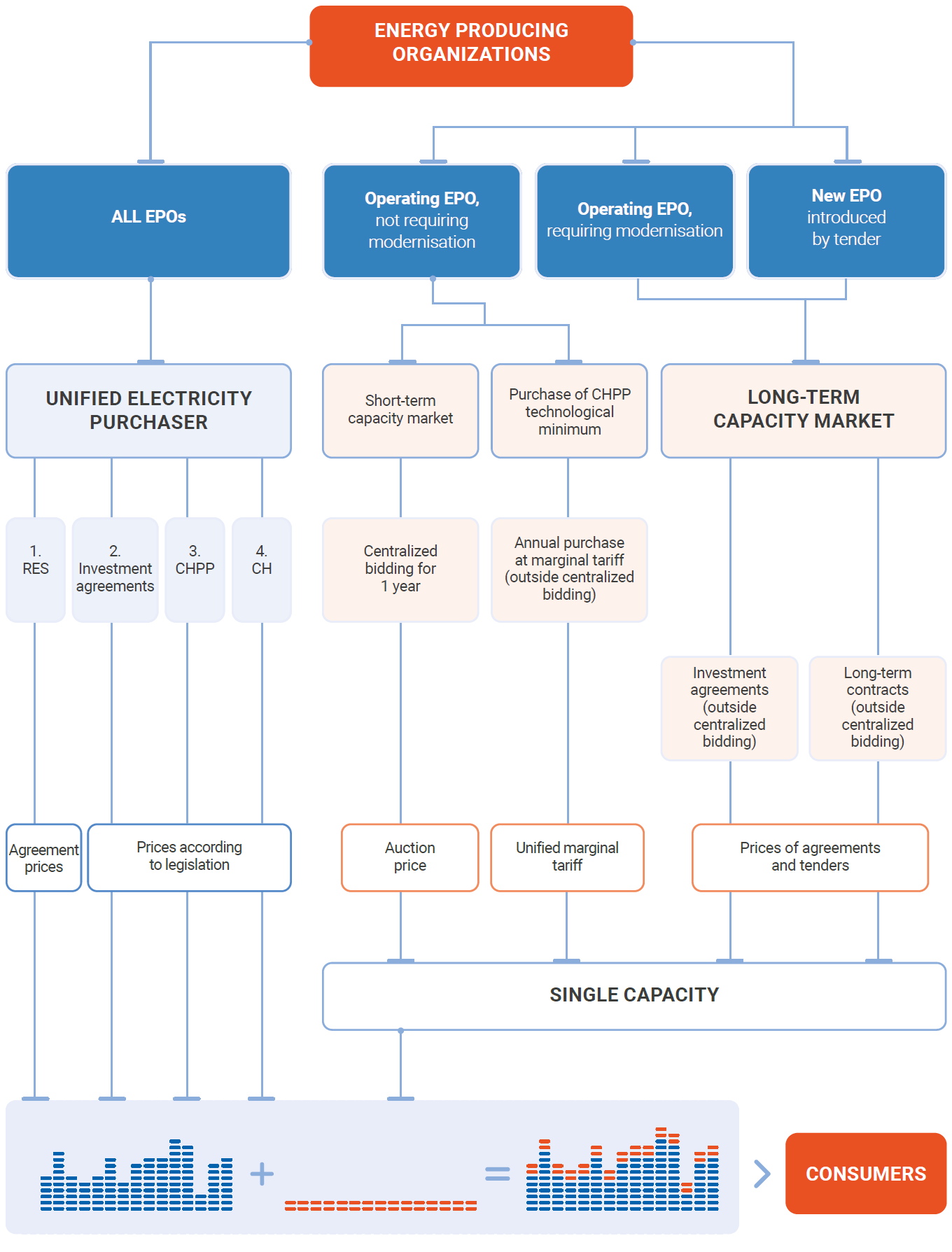

Capacity market

In Kazakhstan, along with the electricity market, a capacity market has been functioning since 2019. Its main goal is to attract investment to maintain existing and create new capacities, as well as to ensure the balance between electricity supply and demand in the country. The capacity market also stimulates the use of renewable energy and increases the efficiency of the energy system.

In 2024, power plants took part in trading on the electric capacity market held on the trading floor of KOREM JSC.

According to the results of centralised bidding held on 27 November 2024, power plants of Samruk-Energy JSC sold 3,594 MW of capacity at a price of 1,165 thousand KZT/MW*month. In particular:

- GRES-1 LLP – 1,390 MW;

- SEGRES-2 JSC – 877 MW;

- AlES JSC – 421 MW.

In accordance with the legislation13 individual capacity tariffs were set for Moynak HPP JSC, Shardara HPP JSC in 2022. For Shardara HPP JSC the volume of capacity was 61 MW, for Moynak HPP JSC – 298 MW. These tariffs will allow enterprises to ensure repayment of borrowed funds used for construction of the power plant (MGES JSC), modernisation of equipment (SharHPP JSC).

13 Law of the Republic of Kazakhstan On Amendments and Additions to Certain Legislative Acts of the Republic of Kazakhstan on Special Economic and Industrial Zones, Attracting Investments, Development and Promotion of Exports, and Social Security No.243-VІ dated 3 April 2019.

Kazakhstan coal market

The thermal coal market in Kazakhstan is characterised by fragmentation. Thus, the main major players are Bogatyr Coal LLP (Samruk-Energy JSC and UC RUSAL), EEC JSC and Shubarkol Komir JSC (ERG), Kazakhmys Corporation LLP, Karazhyra JSC, Angrensor Energy LLP.

According to the Bureau of National Statistics, in January–December 2024, Kazakhstan's coal mining companies produced 108.46 million tonnes of hard coal, which is 3.8% less compared to the same period in 2023.

Coal production, million tonnes

| Indicators | 2022 | 2023 | 2024 | Δ 2024/2023, % |

|---|---|---|---|---|

| Pavlodar region | 68.39 | 69.48 | 67.01 | -3.6 % |

| Karaganda region | 34.28 | 33.58 | 32.36 | -3.6 % |

| East Kazakhstan Region | 8.83 | 7.99 | 20.00 | 614.3 % |

| Total | 113.93 | 112.74 | 108.46 | -3.8 % |

At the end of the reporting period, Bogatyr Coal LLP produced 42.68 million tonnes of coal, which is 0.6% less than in 2023. At the same time, the company's share in production at the end of 2024 was 38.1% of the total volume of coal production in the Republic of Kazakhstan and 66.8% of the volume of coal produced in the Ekibastuz coal basin (Pavlodar region).

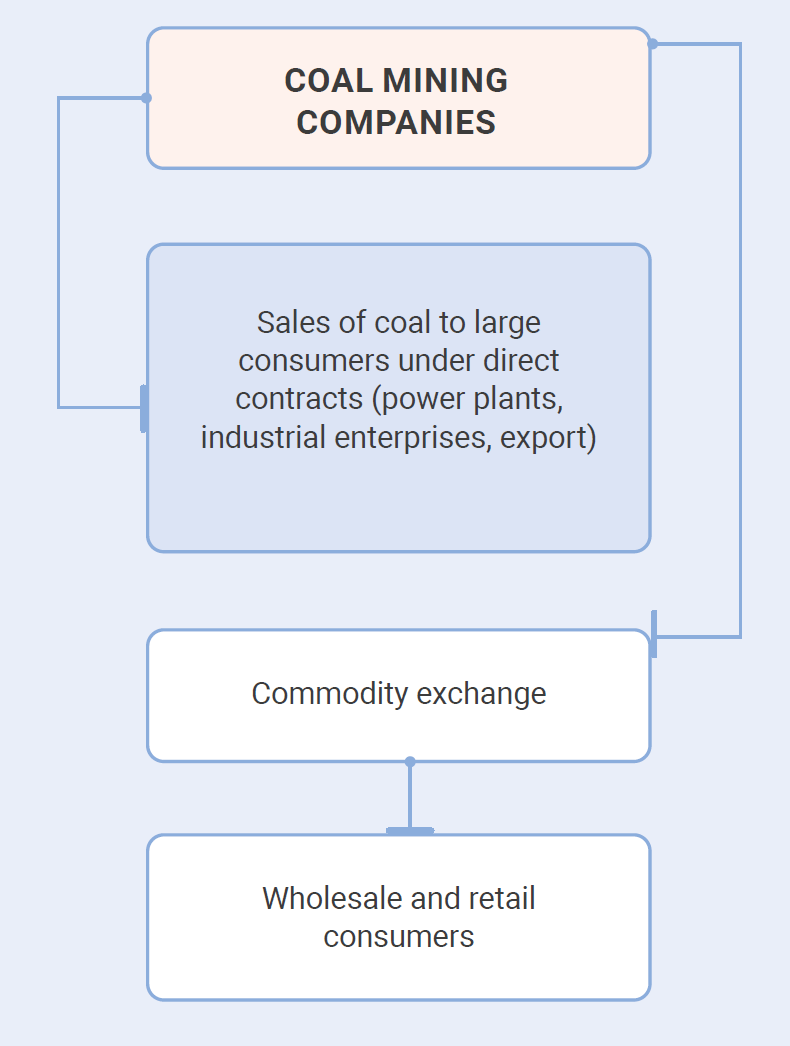

Scheme of coal sales

The stripping ratio for 2024 was 0.94 m³/tonne, compared to 0.84 m³/tonne in 2023.

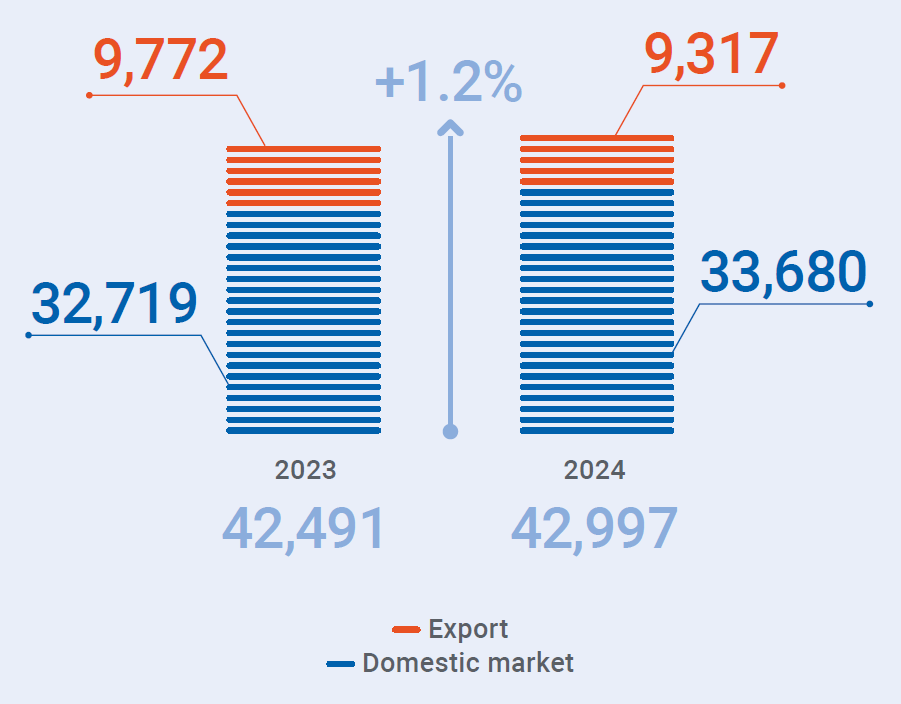

Coal sales by Bogatyr Coal LLP, thousand tonnes

Outlook for the future period

The volume of coal sales in the forecast for 2025 will increase by 2,003 thousand tonnes, or by 4.7% compared to the actual figures for 2024. The growth is due to increased demand from energy-producing organisations.

Among the major coal consumers include Bogatyr Coal LLP, as well as power systems of Astana, Almaty, Karaganda, Petropavlovsk, Pavlodar, Stepnogorsk, Ekibastuz GRES-1 and GRES-2. Coal buyers, including power plants, independently organised and paid for coal transportation from Ekibastuz station (Bogatyr Coal LLP) to the place of destination. Contracts for transportation were concluded with freight forwarders who engage wagon owners (operators).

Ekibastuz coal is the passport (standard) fuel for small boiler houses located in rural areas. The shipment of utility coal, according to the results of exchange transactions, was carried out both by railway and motor transport.

Coal sales to consumers, million tonnes

| Area | 2022 | 2023 | 2024 |

|---|---|---|---|

| AIES JSC | 3.00 | 3.16 | 3.21 |

| Karaganda Energy Centre LLP | 2.31 | 2.56 | 2.57 |

| Astana-Energy JSC | 3.96 | 3.65 | 3.63 |

| Pavlodarenergo JSC PTETs-2, 3 | 2.83 | 2.90 | 3.07 |

| Stepnogorskaya CHPP LLP | 0.80 | 0.71 | 0.70 |

| EGRES-1 LLP | 13.10 | 13.39 | 13.28 |

| JSC EGRES-2 Station | 3.30 | 3.59 | 3.65 |

| Bassel Group LLS LLP | 0.48 | 0.46 | 0.33 |

| SevKazEnergo JSC | 1.44 | 2.11 | 2.17 |

| Ekibastuzteploenergo LLP | 0.52 | 0.45 | 0.54 |

| SCP on PCV Koksh. Zhylu | 0.32 | 0.36 | 0.32 |

| Combite | 0.19 | 0.17 | 0.16 |

| Total to the domestic market of the Republic of Kazakhstan | 32.32 | 32.72 | 33.68 |

| Reftinskaya GRES | 10.08 | 9.77 | 9.31 |

| Total exports to the Russian Federation | 10.08 | 9.77 | 9.31 |

Weighted average selling price of coal, KZT/tonne

| Name | 2021 fact | 2022 fact | 2023 fact | 2024 fact | 2025 forecast |

|---|---|---|---|---|---|

| Bogatyr Coal LLP | 2,292 | 2,669 | 3,084 | 3,215 | 4,168 |

The price of coal sales by Bogatyr Coal LLP is approved independently by the price list for consumers of the Republic of Kazakhstan for 3 groups of consumers (power engineering at the KTZ junction station, power engineering at the coal harvesting station, municipal and household needs).

Tariff Policy

The operating activities of the subsidiaries of the Samruk-Energy JSC Group of companies and its joint ventures, which are subjects of natural monopoly, competitive and socially significant markets, are regulated by the laws of the Republic of Kazakhstan On Electric Power Industry, On Natural Monopolies, On Supporting the Use of Renewable Energy Sources and the Entrepreneurial Code of the Republic of Kazakhstan. Tariff regulation, depending on the type of activity of energy companies, falls under the competence of the Natural Monopolies Regulation Committeeand Protection of Competition of the Ministry of National Economy of the Republic of Kazakhstan (the Committee) or the sectoral ministry – the Ministry of Energy (MoE).

By order of the Minister of Energy of the Republic of Kazakhstan dated May 22, 2020 No.205, the ‘Methodology for Determining Fixed Profit, taken into Account When Approving Ceiling Tariffs for Electric Energy, as well as Fixed Profit for Balancing, taken into Account When Approving Ceiling Tariffs for Balancing Electricity’ was approved.

Based on the Concept for the Development of the Fuel and Energy Complex (FEC) of Kazakhstan until 2030, adopted in 2014, the Capacity Market was introduced in 2019 as an effective mechanism to ensure a sufficient level of investment in the sector, which will have a positive impact on the market in the long term.

Since 2019, taking into account the introduction of the capacity market for energy-producing organizations, the following have been established:

- ceiling tariffs for capacity, which include costs for investment projects and repayment of principal debt (on borrowed funds attracted for the implementation of investment projects).

- ceiling tariffs for electricity, which include costs for electricity production and the profit margin. By order of the Minister of Energy of the Republic of Kazakhstan dated March 11, 2021 No.76, amendments were made to Order No.205 dated May 22, 2020, approving the ‘Methodology for Determining the Profit Margin, taken into Account When Approving Ceiling Tariffs for Electric Energy, as well as Fixed Profit for Balancing, taken into Account When Approving Ceiling Tariffs for Balancing Electricity’.

From July 1, 2023, the Single Buyer model was launched in the Republic of Kazakhstan, which provides for centralized procurement of electricity and the introduction of a real-time balancing electricity market (until July 1, 2023, it operated in simulation mode).

Tariffs for transmission and distribution of electricity for transmission companies, for heat energy production, and tariffs for energy supply organisations (ESO) are regulated by the Natural Monopolies Regulation Committeeand Protection of Competition of the Ministry of Economy. Regulation and control by the Committee are carried out in strict accordance with legislative and regulatory acts.

Tariff decisions are significantly influenced by social and political issues. The economic, social, and other policies of the Government of the Republic of Kazakhstan may have a significant impact on the operating activities of the Samruk-Energy JSC Group of companies.

The transition to a new model of the electricity market based on the mechanism of a Single Buyer of electricity and the balancing electricity market is carried out in real time. With the introduction of the balancing electricity market, the entire volume of electricity purchases is made from a Single Buyer.

In 2024, the electricity tariff for end-users was formed taking into account:

- electricity purchases from a Single Buyer;

- prices for transmission/use of electricity on the National Grid;

- prices for transmission and distribution on the grids of the REC;

- the cost of regulation, balancing and dispatching services;

- the cost of services to ensure the availability of electric capacity.

Weighted average tariffs for electricity generation (excluding VAT)

| Name of subsidiaries and affiliates | 2022 fact14 | 2023 fact15 | 2024 fact16 | 2025 forecast |

|---|---|---|---|---|

| Ekibastuz GRES-1 LLP | 8.06 | 8.00 | 9.18 | 10.50 |

| electricity tariff, KZT/kWh | 7.44 | 7.59 | 8.12 | 9.09 |

| RK tariff | 7.44 | 7.59 | 8.12 | 9.09 |

| capacity tariff, thousand KZT/MW*month | 590 | 590 | 1,049 | 1,165 |

| individual capacity tariff, thousand KZT/MW*month | — | — | — | 1,199 |

| Station Ekibastuzskaya GRES-2 JSC | 11.39 | 11.46 | 13.65 | 17.92 |

| export tariff, KZT/kWh | 13.76 | 13.76 | — | — |

| electricity tariff, KZT/kWh | 10.17 | 10.27 | 11.76 | 15.75 |

| capacity tariff, thousand KZT/MW*month | 590 | 590 | 1,020 | 1,160 |

| Almaty Electric Stations JSC | 14.05 | 15.52 | 20.38 | 22.99 |

| electricity tariff, KZT/kWh | 12.27 | 13.79 | 17.81 | 20.29 |

| weighted average tariff for capacity, thousand KZT/MW*month | 796 | 809 | 1,180 | 1,160 |

| capacity tariff, thousand KZT/MW*month | 590 | 590 | 1,062 | 1,160 |

| individual capacity tariff, thousand KZT/MW*month | 3,139 | 3,139 | 2,479 | — |

| JSC Moynak HPP | 21.69 | 23.51 | 21.59 | 24.05 |

| electricity tariff, KZT/kWh | 12.92 | 13.65 | 14.08 | 13.77 |

| capacity tariff, thousand KZT/MW*month | 2,564 | 2,564 | 2,564 | 2,564 |

| JSC Shardara HPP | 16.03 | 16.33 | 14.69 | 15.53 |

| electricity tariff, KZT/kWh | 10.79 | 11.77 | 9.84 | 9.82 |

| capacity tariff, thousand KZT/MW*month | 3,868 | 3,868 | 3,868 | 3,868 |

| AES Ust Kamenogorsk HPP LLP | — | — | 5.79 | 6.85 |

| electricity tariff, KZT/kWh | — | — | 3.57 | 4.19 |

| capacity tariff, thousand KZT/MW*month | — | — | 1,060 | 1,160 |

| AES Shulbinsk HPP LLP | — | — | 8.15 | 9.56 |

| electricity tariff, KZT/kWh | — | — | 4.55 | 4.93 |

| capacity tariff, thousand KZT/MW*month | — | — | 1,060 | 1,160 |

| Samruk-Green Energy LLP, KZT/kWh17 | 20.94 | 23.54 | 27.63 | 30.76 |

| First Wind Power Plant LLP | 36.84 | 43.36 | 48.47 | 52.35 |

| Energy of Semirechye LLP, share 25% | 22.68 | 24.65 | 28.17 | 31.58 |

By the Order of the Minister of Energy of the Republic of Kazakhstan dated 23.10.2023 No.376 ceiling tariffs for the service of maintaining the availability of electric capacity are set at the level of 1,065 thousand KZT/ MW*month, and for 2025 – 1,170 thousand KZT/MW*month.18

14 The electricity tariff consists of a feed-in tariff and a pass-through RES surcharge.

15 The electricity tariff is a weighted average of the feed-in tariff and the RES pass-through allowance until 1 July 2023, and of the feed-in tariff and the BRE tariff from 1 July 2023.

16 The electricity tariff consists of a marginal tariff and a BRE tariff.

17 The electricity tariff of Samruk-Green Energy LLP is a weighted average of the four RES plants.

18 Order of the Acting Minister of Energy of the Republic of Kazakhstan dated 19 November 2024 No.407.

Due to the expected increase in p operating expenses (increase in personnel, fuel costs, etc.), to achieve tariff break-even, from 2024, the EPO submitted an application for adjustment of the ceiling tariff in accordance with the rules for approving the ceiling tariff for electricity19. The application was submitted by 1 September 2023. As a result, new ceiling tariffs for electricity were approved, which come into force on January 1, 2024.20

19 Order of the Minister of Energy of the Republic of Kazakhstan dated 27.02.2015.

20 DOE Order No.479 dated 28 December 2023.

Thus, during 2024, the following ceiling electricity tariffs (KZT/kWh, excluding VAT) were in effect for EPO:

| Name of EPO | Approved tariff 01.01.2024 | Approved tariff from 01.11.2024 | Off, % | Approved tariff from 01.02.2025 | Off, % |

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4=3/2 | 5 | 6=5/3 |

| EGRES-1 LLP | 8.05 | 8.27 | 3% | 9.50 | 15% |

| SEGRES-2 JSC | 13.17 | 13.17 | 0% | 15.67 | 19% |

| AIES JSC | 17.82 | 17.82 | 0% | 20.93 | 17% |

| NPP SHGES LLP | 4.14 | 4.14 | 0% | 5.04 | 22% |

| NPP UKGES LLP | 3.44 | 3.44 | 0% | 4.29 | 25% |

| SharGES JSC | 9.82 | 9.82 | 0% | 9.82 | 0% |

| MGES JSC | 12.77 | 12.77 | 0% | 12.77 | 0% |

Also, the Order of the Minister of Energy of the Republic of Kazakhstan dated 27 January 2025 (No.42-n/k) approved the ceiling tariffs for electric power of EPO with effect from 1 February 2025.

Starting from 2020, the Ministry of Energy of the Republic of Kazakhstan is working with the Ministry of Energy of the Republic of Kazakhstan to approve investment tariffs for plants implementing large-scale investment projects – Moynak HPP JSC, Shardara HPP JSC, Almaty Electric Stations JSC and Ekibastuz GRES-1 LLP.

Parameters of concluded investment agreements, thousand KZT/MW*month

| Name of EPO | Scope | Individual tariff (excluding VAT) |

Period |

|---|---|---|---|

| Almaty Electric Stations JSC | 69.5 MW | 4,168.60 | 2020–2024 |

| Moynak HPP JSC | 298 MW | 2,563.67 | 2020–2026 |

| Shardara HPP JSC | 61 MW | 4,069.3 | 2020–2028 |

On December 28, 2021, Ekibastuz GRES-1 LLP concluded an Investment Agreement with the Ministry of Energy of the Republic of Kazakhstan for modernisation, reconstruction, expansion, and renewal under the project for the restoration of power unit No.1, with a tariff of 1,199 thousand KZT /MW*month for the period 2025–2031, based on a service volume of 476.6 MW.

During 2024, applications were submitted for individual tariffs for the construction of Power Units No.3 and No.4, taking into account changes in the Rules for Selection of Investment Programmes and clarification of completion dates for power unit No.3 until September 2028 and for power unit No.4 until September 2030. The Presidium of the Market Council approved the updated applications and sent them to the Ministry of Energy of the Republic of Kazakhstan. Investment Agreement No.41 was signed with the Ministry of Energy of the Republic of Kazakhstan for implementation of power unit No.3 with a 10-year investment payback period (4Q 2028 – 3Q 2038). The signing of the agreement for power unit No.4 was postponed until the issue of increasing limits on the capacity market is resolved. Corporate procedures were completed to conclude a contract for the purchase of capacity availability maintenance service with Settlement and Financial Centre for RES Support LLP. The contract for the purchase of the electric capacity readiness service for the 3rd power unit was signed with Settlement Financial Centre LLP.

Tariffs for heat production21, KZT/Gcal (excluding VAT)

| Name | 2022 fact | 2023 fact | 2024 fact | 2025 forecast |

|---|---|---|---|---|

| Almaty Electric Stations JSC | 3,782 | 4,215 | 5,195 | 5,394 |

| Station Ekibastuzskaya GRES-2 JSC | 812 | 874 | 902 | 929 |

| Ekibastuz GRES-1 LLP | 221 | 189 | 183 | 178 |

| Energy Solutions Centre LLP (Ekibastuz CHPP) | - | - | 6,018 | 6,654 |

21Heat tariffs are annual averages.

As a subject of natural monopoly, the legislation provides for the approval of long-term (5+ years) ceiling tariff levels for organisations producing heat energy, including an investment component and annual indexation of costs. Ceiling tariffs are approved by the Committee. However, the increase of tariffs at the initiative of the CEM is made not more than once a year and there are risks of maintaining tariffs without increase, in cases of growth of plant costs due to objective reasons.

Due to the social significance of heat energy prices, the Natural Monopolies Regulation Committee implements the state policy of restraining the growth of heat energy tariffs, which leads to unprofitability of heat energy production activities.

From 1 January 2023, the tariff of Almaty Electric Stations JSC for heat energy was 4,003.36 KZT/Gcal. As a result of work with DKREM, new tariffs for heat energy were approved taking into account the increase in prices for strategic commodities (coal, fuel oil) and growth of average monthly wages:

- from 01.08.2023 – 4,550.44 KZT/Gcal, growth to the previous tariff – 13,7%;

- from 01.01.2024 – 5,063.54 KZT/Gcal, growth to the tariff of 2023 – 26.5%;

- from 01.09.2024 – 5,412.67 KZT/Gcal, growth to the tariff of 2023 – 36.8% (average annual tariff in 2024 was 5,195 KZT/Gcal);

- from 01.01.2025 – 5,394.18 KZT/Gcal.

In 2025, Almaty Electric Stations JSC and the Company plan to further work with DKREM to ensure break-even heat operations.

Tariffs for electricity transmission services, KZT/kWh (excluding VAT)

| Name | 2022 fact | 2023 fact | 2024 fact | 2025 forecast |

|---|---|---|---|---|

| Alatau Zharyk Company JSC | 6.58 | 7.68 | 9.95 | 10.6 |

Joint Order of the Department of the Natural Monopolies Regulation Committeeof the Ministry of National Economy of the Republic of Kazakhstan for Almaty city from 25 July 2024 No.64-OD and the Department of the Natural Monopolies Regulation Committeeof the Ministry of National Economy of the Republic of Kazakhstan for Almaty region dated 26 July 2024 No.92-OD, made changes to the joint Order of the Department of the Natural Monopolies Regulation Committeeof the Ministry of National Economy of the Republic of Kazakhstan for Almaty city dated 6 November 2020 No.126-OD and the Department of the Natural Monopolies Regulation Committeeof the Ministry of National Economy of the Republic of Kazakhstan for Almaty region dated November 6, 2020 No. 154-OD “On Approval of Ceiling Tariff Levels and Tariff Estimates for the Regulated Service of JSC 'Alatau Zharyk Company' for Electricity Transmission for 2021–2025”.

The changes were made in accordance with paragraph 1 of Article 22 of the Law of the Republic of Kazakhstan On Natural Monopolies in connection with the submitted application of AZhK JSC within the framework of the Tariff in exchange for investment programme on the following grounds:

- change in the cost of strategic goods (electricity);

- change of the approved investment programme in connection with the implementation of state programmes, as well as documents of the state planning system approved by the authorised body;

- increase in the volume of regulated services provided;

- obtaining property used in the technological cycle in the provision of regulated services by natural monopolies on the balance sheet and (or) in trust management;

- change in the average monthly nominal wage of one employee by type of economic activity in the region (city), developed according to statistics for the year.

In connection with the amendments, the tariff ceilings of AZhK for regulated services for 2024–2025 have been approved:

- from 1 January 2024 – 8.87 KZT/kWh (excluding VAT);

- from 1 August 2024 – 11.4 KZT/kWh (excluding VAT) (average annual transmission tariff in 2024 was 9.95 KZT/kWh);

- for 2025 – 10.6 KZT/kWh (excluding VAT).

Tariffs for electricity sales to ESOs, KZT/kWh (excluding VAT)

| Name | 2022 fact | 2023 fact | 2024 fact | 2025 forecast |

|---|---|---|---|---|

| AlmatyEnergoSbyt LLP | 20.09 | 23.64 | 28.03 | - |

| Alatau Zharyk Kompanasy JSC – Power Supply Company | - | - | - | 34.14 |

In December 2023, as a result of the work carried out, AlmatyEnergoSbyt LLP was included in the list of recipients of targeted support for energy supplying organisations by Order No.276 of the Minister of National Economy of the Republic of Kazakhstan dated 22 December 2023. As a result, the price for electricity purchase from the Single Buyer was 13.00 KZT/kWh, which allowed AlmatyEnergoSbyt LLP to avoid losses in 2024 from the difference between the electricity prices stipulated in the tariff estimates and the actual prices of the Single Buyer.

On 10 October 2024, the Department of the Natural Monopolies Regulation Committee of Almaty city and Almaty region approved the ceiling price of AlmatyEnergoSbyt LLP at 29.04 KZT/kWh (an increase of 3.7%) effective from 15 October 2024.

Due to the amendments made in the Law of the Republic of Kazakhstan On Electricity, the Law of the Republic of Kazakhstan On Amendments and Additions to Certain Legislative Acts of the Republic of Kazakhstan on Heat Power, Electricity and Regulated Services dated 31 December 2024, AlmatyEnergoSbyt LLP ceased its activity as an energy supplying organisation from 1 January 2025 and was reorganised by joining the regional energy transmission company Alatau Zharyk Company JSC as a Branch of Alatau Zharyk Company JSC – Energosbyt.

Earlier tariffs of AlmatyEnergoSbyt LLP agreed with the Departments of the Committees for Regulation of Natural Monopolies in Almaty city and Almaty region are transferable for Alatau Zharyk Company JSC and are effective from 1 January 2025.

AZhK JSC plans to revise its electricity sales tariff in 2025, taking into account the increase in electricity purchase tariffs from the Single Buyer and other expenses.